Taiwan Semiconductor Manufacturing Company (TSMC) has surged back into the ranks of the world's 10 most valuable companies. This resurgence is fueled by the ongoing artificial intelligence (AI) revolution sweeping the tech industry, propelling TSMC's stock to unprecedented heights.

A recent Bloomberg report highlighted TSMC's impressive 14% stock rally last week. This surge elevated the chipmaker's market capitalization to a record level. Although early trading on Monday, March 11, saw a slight 2% dip, the company's market capitalization remained substantial at $634 billion.

Despite the minor setback, TSMC maintains a higher market capitalization than Broadcom, according to the report.

Experts at Morgan Stanley and JPMorgan Chase & Co. predict further growth for the semiconductor giant. Their optimism is based on the company's key clientele, including Apple, Nvidia, and Qualcomm, as well as surging revenues linked to AI and considerable pricing leverage.

Morgan Stanley analysts, including Charlie Chan, noted the significance of generative AI for TSMC's growth in a recent report. They also pointed out that the company's international expansion mitigates potential geopolitical risks.

TSMC's revenue experienced a 9.4% increase in the first two months of 2024. This growth is attributed to heightened demand for high-end chips spurred by the surge in AI-related activities.

TSMC isn't the only chip company experiencing significant stock growth this year. Nvidia has also benefited from the generative AI boom.

Over the past month, Nvidia's stock price has increased by more than 20%. The growth is even more impressive over the last six months, with a rise exceeding 90%. Looking at the past year, Nvidia's stock price has skyrocketed from $234.36 per share to $875.28, marking a staggering 275% increase.

Newer articles

Older articles

Vijay Officially Named TVK's Chief Minister Hopeful for Tamil Nadu's 2026 Election

Vijay Officially Named TVK's Chief Minister Hopeful for Tamil Nadu's 2026 Election

RJ Mahvash Prioritizes Work Over Buzz, Addresses Link-Up Speculation

RJ Mahvash Prioritizes Work Over Buzz, Addresses Link-Up Speculation

UNESCO's World Heritage Wonders: Unveiling 10 Iconic Sites, From Petra to the Pyramids

UNESCO's World Heritage Wonders: Unveiling 10 Iconic Sites, From Petra to the Pyramids

JPG to PDF: A Comprehensive Guide for Graphic Designers & Professionals

JPG to PDF: A Comprehensive Guide for Graphic Designers & Professionals

iQoo Z9 Turbo: Rumored Specs Emerge – Snapdragon 8s Gen 3, 6000mAh Battery Highlighted

iQoo Z9 Turbo: Rumored Specs Emerge – Snapdragon 8s Gen 3, 6000mAh Battery Highlighted

Shadman Islam Defends Bangladesh Batters After Day 1 Struggles Against Sri Lanka

Shadman Islam Defends Bangladesh Batters After Day 1 Struggles Against Sri Lanka

England's Bold Claim: Could They Have Chased Down 450 Against India?

England's Bold Claim: Could They Have Chased Down 450 Against India?

5 Often-Missed Warning Signs of Bladder Cancer You Need to Know

5 Often-Missed Warning Signs of Bladder Cancer You Need to Know

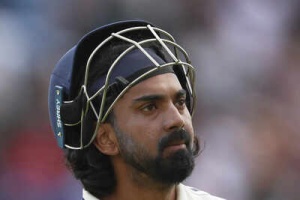

KL Rahul Puts Country First, Prioritizes England Tests Over Newborn Child

KL Rahul Puts Country First, Prioritizes England Tests Over Newborn Child

Tick Bite Paralyzes Fitness Influencer: A Wake-Up Call for Outdoor Enthusiasts

Tick Bite Paralyzes Fitness Influencer: A Wake-Up Call for Outdoor Enthusiasts